How Much Does It Cost to Sell a House in Arkansas? | Net Proceeds & Closing Costs Explained

How much does it cost to sell a house in Arkansas? That’s one of the most common questions homeowners ask—especially when trying to understand the estimated closing costs for a seller in Arkansas.

If you’re thinking about putting your property on the market, knowing the true cost of selling can help you avoid surprises and plan for your next move. From agent commissions and title fees to repairs and final mortgage payoff, these expenses can quickly add up—and directly impact how much cash you walk away with at closing.

In this guide, we’ll break down all the typical costs sellers face in Arkansas, show you how to calculate your net proceeds, and even give you access to a free tool that estimates your bottom line. Whether you’re selling a house in Little Rock, Benton, Conway, or anywhere in between, this page is designed to help you make confident, informed decisions.

Typical Closing Costs for Sellers in Arkansas

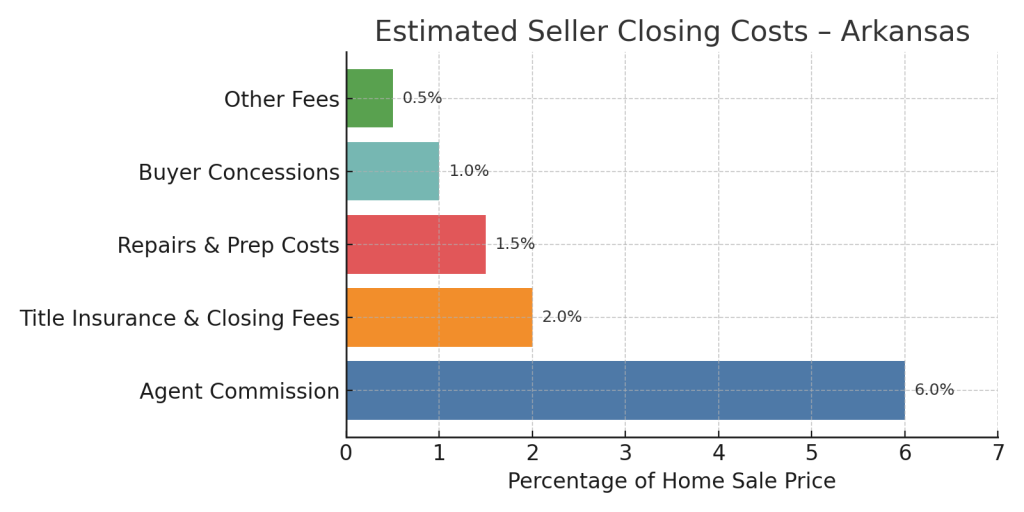

When selling a home, it’s crucial to understand the estimated closing costs for a seller in Arkansas, as they can take a significant portion out of your final proceeds. While exact numbers vary depending on your property and negotiation terms, most Arkansas home sellers can expect to pay between 6% to 10% of the home’s sale price in total selling costs.

Here’s a breakdown of the most common seller-paid closing costs in Arkansas:

Real Estate Agent Commission (5%–6%) – This is typically the largest cost, split between the buyer’s and seller’s agents.

Title Insurance – In Arkansas, sellers are often expected to pay for the buyer’s title insurance policy.

Attorney Fees – While not mandatory, many sellers choose to have legal representation during closing, especially in more complex sales.

HOA Transfer Fees – If your home is in an HOA community, you may owe a transfer or document fee.

Escrow or Settlement Fees – Depending on the title company and sale terms.

Recording Fees – Local counties may charge small fees for recording the transaction.

💡 Good to know: Unlike some other states, Arkansas doesn’t charge a state-level transfer tax on real estate transactions—which helps reduce your total costs.

These costs can feel overwhelming at first, but having a clear understanding of them allows you to make better pricing and negotiation decisions. Want to avoid realtor fees altogether? You can explore selling your house by owner in Arkansas (FSBO) to save on realtor commission. In the next section, we’ll cover other optional costs you might face—like repairs or staging—and how they affect your net proceeds.

Other Costs Arkansas Home Sellers Should Expect

In addition to standard closing costs, there are several optional or situational expenses that can sneak up on sellers and impact your final profit. These often aren’t part of your estimated closing costs on paper—but they absolutely affect your net proceeds at closing.

Here are some common out-of-pocket costs to consider:

Repairs & Updates – Buyers may request repairs after home inspections, or you might choose to make improvements ahead of listing to attract better offers.

Staging & Cleaning – Professional staging, deep cleaning, and photography can cost hundreds, but may help your home sell faster.

Pre-Inspection Reports – To prepare your home for sale, it’s wise to have your home inspected to identify any issues ahead of time (optional, but proactive).

Holding Costs – Mortgage payments, property taxes, insurance, HOA fees and utilities continue until the sale officially closes.

Buyer Concessions – You might agree to cover part of the buyer’s closing costs to secure a deal—especially in a slower market.

🔧 Thinking of skipping repairs and selling your house as-is in Arkansas? That’s possible—and it could save you thousands in prep costs.

These hidden or overlooked expenses can significantly affect what you actually walk away with. That’s why having a clear idea of your net proceeds is essential. If you’re selling a home that’s part of an estate, hiring a real estate attorney can be especially helpful—check out our guide on how probate works in Arkansas. In the next section, we’ll show you how to calculate it—and give you a free tool to make it easy.

How to Calculate Your Net Proceeds in Arkansas

Your net proceeds are the actual amount of money you’ll walk away with after selling your home—not the listing price you see on the contract. Understanding this number helps you make smarter decisions, whether you’re planning your next home purchase or simply want to cash out.

Here’s a simple formula to estimate your net proceeds:

Sale Price

– (Agent Commissions + Closing Costs + Mortgage Payoff + Other Expenses)

= Net Proceeds

Let’s break that down:

-

Sale Price – The final agreed-upon price of your home.

-

Commission Rates – Usually 5%–6% split between agents.

-

Closing Costs – Title insurance, legal fees, recording fees, etc.

-

Outstanding Mortgage – Any remaining loan balance still owed.

-

Other Expenses – Repairs, staging, concessions, and holding costs.

Arkansas Home Selling Cost Estimator

Estimated Selling Costs & Proceeds

Total Estimated Selling Costs: $0

Estimated Net Proceeds: $0

Disclaimer: This calculator provides estimates based on the inputs provided. Actual costs may vary. Consult with a real estate professional for accurate figures.

Net Proceeds Example for an Arkansas Home Sale

Let’s walk through a real-world example of how to calculate your net proceeds from selling a house in the Arkansas real estate market:

Example Scenario:

Sale Price: $200,000

Agent Commission (6%): $12,000

Title Insurance & Closing Fees: $2,000

Outstanding Mortgage Balance: $130,000

Repairs & Misc. Costs: $1,500

Buyer Concessions (covering some of buyer’s closing costs): $2,000

Step-by-Step Calculation:

Total Selling Costs

= $12,000 (commission) + $2,000 (closing fees) + $1,500 (repairs) + $2,000 (concessions)

= $17,500Net Sale Value After Costs

= $200,000 – $17,500

= $182,500Subtract Mortgage Payoff

= $182,500 – $130,000

= $52,500 in Net Proceeds

Final Net Proceeds: $52,500

This is the amount the seller would receive after all costs are paid at closing.

🛠️ Want to skip the repairs and agent fees? You may be able to sell your house as-is for cash and walk away with a faster, simpler closing.

How to Maximize Your Net Proceeds When Selling in Arkansas

While some selling costs are unavoidable, there are several smart strategies Arkansas homeowners can use to keep more money in their pocket at closing. Whether you’re selling with an agent or exploring a cash sale, these tips can help you improve your bottom line:

Price Your Home Competitively

Overpricing can lead to longer time on market and price reductions. A well-priced home tends to sell faster and with fewer concessions.

Minimize Repairs (or Sell As-Is)

If you’re dealing with costly repairs, consider selling your home as-is—especially to a local cash homebuyer. This lets you skip inspections, staging, and renovation costs altogether.

Compare Agent vs. Direct Sale

While agents bring exposure, they also charge commissions. For homes in need of updates or quick closings, selling directly to a local buyer for cash might yield higher net proceeds—even with a lower sale price. If you’re considering selling your house directly to a cash buyer to save on fees and speed up the process, make sure you also understand how to avoid getting ripped off when selling your house for cash. Not all buyers operate with transparency, and knowing the red flags can protect your net proceeds.

Avoid Paying Buyer Concessions

In slower markets, buyers may ask you to cover some of their closing costs. If possible, stand firm or factor that into your initial pricing strategy.

Frequently Asked Questions About Selling a House in Arkansas

These are common questions we hear from Arkansas homeowners planning to sell. We’ve included quick, straightforward answers to help you feel confident in your next steps.

On average, sellers in Arkansas can expect to pay around 6% to 10% of the home’s sale price in total selling costs. This typically includes real estate commissions, title insurance, and other closing-related fees.

Yes. In most traditional sales, the seller pays both the listing agent’s and buyer’s agent’s commissions—usually totaling 5% to 6% of the final sale price.

Selling your house as-is to a local cash buyer can often save you money on repairs, agent commissions, and closing costs. This route is ideal for sellers looking to avoid upfront expenses and close quickly.

Final Thoughts: Know Your Numbers Before You Sell

Selling a home in Arkansas involves more than just agreeing on a price—what truly matters is what you walk away with at closing. By understanding your estimated closing costs, factoring in extra expenses, and calculating your net proceeds, you can make smarter decisions and avoid costly surprises.

Whether you’re listing with an agent or considering a cash offer, knowing your numbers puts you in control.

Want a Quick Estimate of Your Net Proceeds?

Use the example above to run your numbers—or reach out to us for a free, no-obligation cash offer that skips fees, repairs, and delays. Inheriting a home? Learn what to expect with our full guide to selling an inherited house in Arkansas.

👉 We make selling your house in Arkansas simple, fast, and transparent.